The 2026 Tax Playbook: 3 Shifts That Make Homeownership Financially Smarter

For three years, buyers have been told to "wait for rates to drop." They missed the bigger story: the tax code just shifted in their favor—and it's worth more than a quarter-point rate cut.

Homeownership just became more financially efficient, and if you're buying, refinancing, or advising clients this year, this changes the conversation.

Three major tax benefits are back under the One Big Beautiful Bill Act (OBBBA), and they're not theoretical. These are real line items that affect how much tax you pay and what ownership actually costs.

Here's what's live, who benefits, and how to use it.

AT A GLANCE: WHAT CHANGED FOR 2026

1. The SALT Cap Jumped to $40,000

The State and Local Tax (SALT) deduction has been capped at $10,000 since 2018—a move that hit middle-class homeowners in high-tax states hardest.

The Change:

For households earning under $500,000, the SALT cap increases to $40,000 starting with tax year 2025 (filed in 2026).

Why This Matters:

If you're in California, New York, New Jersey, Illinois, or any state with higher property or income taxes, this makes itemizing viable again.

When you combine:

Property taxes

State income taxes

Mortgage interest

...you're more likely to cross the threshold where itemizing beats the standard deduction, lowering your federal tax liability.

Who Benefits Most:

Homeowners in high-tax states

Dual-income households with significant mortgage interest

Move-up buyers who were close to itemizing under the old cap

What to Do:

Track property tax payments carefully

Keep state tax documentation

Review whether itemizing beats the standard deduction with your tax professional

This is real money back in your pocket—not because rates dropped, but because the tax structure shifted.

2. PMI Is Tax Deductible Again—Permanently

For years, buyers were told PMI was "dead money"—a cost with no upside.

That changes now.

The Change:

Starting with tax year 2026, private mortgage insurance (PMI) and FHA mortgage insurance premiums (MIP) can be treated like deductible mortgage interest—if you itemize.

What This Covers:

PMI on conventional loans (if you put down less than 20%)

MIP on FHA loans

Any ongoing monthly mortgage insurance premium

When You Can Claim It:

If you buy or refinance in 2026, you'll claim this deduction when you file your taxes in 2027.

Why This Changes the Conversation:

PMI is no longer just a sunk cost. For the average homeowner, this could mean an annual deduction of approximately $1,400 to $2,300.

At a 24% tax bracket, that's $336 to $552 back annually—real money that lowers the effective cost of putting down less than 20%.

What to Do:

Keep your annual mortgage interest statement (Form 1098)

Confirm whether PMI is itemized separately

Review eligibility with your tax professional

The penalty for putting down less than 20% just got smaller.

3. Upfront Mortgage Insurance Is Deductible Too

This is the tax win many buyers miss.

The Change:

If you paid upfront mortgage insurance in 2026—whether single-premium PMI, FHA upfront MIP, or VA funding fees—that's now tax deductible in the year you paid it.

What Qualifies:

Single-premium PMI (paid at closing on conventional loans)

FHA upfront mortgage insurance premium (1.75% of loan amount)

VA funding fee (varies by service history and down payment)

When You Can Claim It:

If you closed in 2026, you'll deduct this when you file in 2027.

Why This Is Meaningful:

Upfront mortgage insurance can add thousands to closing costs. On a $400,000 FHA loan, that's $7,000 in upfront MIP.

Being able to deduct that in the year you paid it makes the true cost lower, especially if you're in a higher tax bracket.

What to Do:

Keep your Closing Disclosure

Save loan documents showing upfront insurance or funding fees

Ask your tax professional what qualifies and how it should be reported

Documentation is key here.

WHAT THIS MEANS FOR BUYERS

If you're buying in 2026, here's what just got better:

✅ The effective cost of homeownership dropped—especially if you're itemizing and carrying PMI or MIP

✅ Putting down less than 20% is less penalized—PMI and MIP now function more like mortgage interest for tax purposes

✅ High-tax states became more buyer-friendly—the SALT cap increase makes property tax less of a burden

These aren't speculative benefits. They're live deductions that apply to real transactions happening right now.

WHAT THIS MEANS FOR REALTORS

If you're working with buyers or presenting offers, this is part of the value conversation now.

Use It to Re-Engage "Wait-and-See" Buyers

Many clients still assume homeownership offers little tax advantage. That assumption is outdated.

The "true" monthly cost of a home is often lower when you factor in these new tax advantages.

Use It to Frame Affordability

When a buyer is comparing monthly payments, remind them that PMI isn't a pure expense anymore if they're itemizing. The tax benefit reduces the net cost.

Use It to Close Deals Faster

If a buyer is waiting to save 20% down to avoid PMI, this changes the math.

Run the numbers with them. The tax benefit might make moving now smarter than waiting another year.

📋 SCRIPT FOR YOUR NEXT BUYER CONSULTATION:

"I know you're watching rates closely. But here's what most buyers don't know: the tax code changed significantly for 2026. Between the higher SALT cap, deductible PMI, and FHA benefits, your effective monthly cost could be $200-400 lower than the payment shows. Want me to run those numbers with you?"

WHAT YOU NEED TO KEEP

If you're closing a deal in 2026, make sure you hold onto:

📄 Form 1098 (Mortgage Interest Statement)—your lender will send this

📄 Closing Disclosure—especially if you paid upfront MIP or a VA funding fee

📄 PMI statements—if you're paying monthly mortgage insurance

You'll need these documents when you file. And if you're not sure what qualifies or how to claim it, talk to your tax professional before you file.

💡 WHAT TAX PROFESSIONALS ARE SAYING:

CPAs across the country are updating their 2026 buyer guidance to reflect these changes. Major accounting firms have issued client advisories on the SALT cap increase. This isn't speculation—it's filed legislation that impacts real returns.

THE BOTTOM LINE

We don't sell hype. We interpret the market.

These tax changes are a strategic tailwind for the 2026 housing market. While headlines focus on the Fed, the smart money is looking at the tax return.

For homeowners and buyers: This is how you stay ahead. Keep your documents, understand your options, and confirm details with a qualified tax professional.

For Realtors: This is your conversation starter for 2026. Educating clients on itemization strategy, PMI deductions, and FHA/VA fee treatment positions you as a trusted advisor—not just a transaction guide.

📊 WANT TO SEE HOW THIS APPLIES TO YOU?

💬 Comment "Tax Wins" below and I'll run a custom breakdown for your specific situation.

📈 Tracking rate windows? Use my [Rate Tracker] to monitor market movements while you calculate your real bottom line.

👉 Follow for more clear, practical housing insights that help you make smarter decisions.

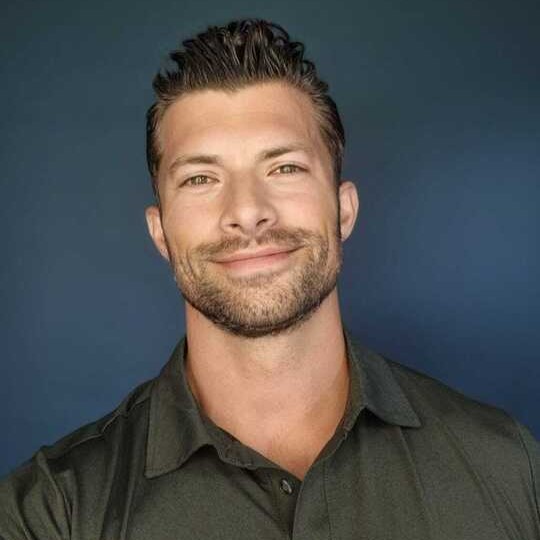

ABOUT MICHAEL VRLAKU

Michael Vrlaku specializes in complex mortgage strategy for high-net-worth clients, with expertise in jumbo loans, asset depletion lending, and strategic timing decisions. He's helped buyers and Realtors navigate multi-million dollar transactions by combining tax strategy, rate timing, and deal structure. For mortgage insights that don't just inform but actually move transactions forward, connect with him on LinkedIn | Instagram.